Back in 2015, I was invited by conference chair Trent Van Doren to lead a workshop at the Atlantic Region Energy Expo in Atlantic City, New Jersey. The subject was “Market Research Basics for Small Business”. Owner-operators of heating oil delivery companies comprised the audience. Typically, these companies have between 5 and 25 employees, and they don’t reserve a lot of budget (if at all) for market research. We estimate that most companies with at least $500,000 in annual revenue will spend somewhere between 0.5% and 2.5% on market research functions (as defined loosely to include the purchase of industry-specific syndicated reports, printing of customer satisfaction survey cards for restaurant tables, etc.)

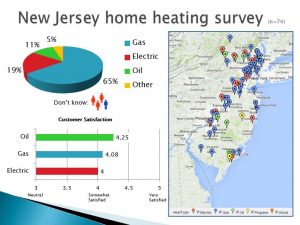

One part of the presentation seemed to knock the socks off those in the audience. I showed them that they could obtain free (though outdated) reports that profile the percentage of New Jersey homes that are heated by natural gas, heating oil, electricity, propane, and wood. But there didn’t seem to be a single available market research survey that measured how satisfied New Jersey households were with their home heating energy source of choice. Nobody had ever conducted such a survey and shared the results.

I asked the audience how valuable it would be to their marketing strategy if they could claim that a survey concluded that heating oil customers were more satisfied with their home heating solution than natural gas or electric customers. Everyone nodded in agreement — that would be very helpful to them!

Then I showed them this chart:

The audience really liked what they saw. Granted, the survey sample size was fairly limited (only 74 respondents), but here — finally — was some smidgen of hope that heating oil customers were measurably more satisfied than customers of natural gas heat or electric heat!

How much did the survey cost?

The New Jersey home heating survey described above took me about eight hours to design, upload to an online data collection platform, keep tabs on the response rate over time, analyze the final results, and create an engaging report deck. If I valued my time at $100 per hour, then we’re about $800 invested into this process. But since this study was constructed really just to prove a point for a conference workshop, the only real out-of-pocket costs were associated with finding and compensating the n=74 respondents.

For that important step, I used the Amazon Mechanical Turk platform. Its participant base may not be fully representative of the general population (just think what types of consumers are standing by to complete whatever questionnaire is thrown in front of them). The survey had to run for more than a month, just to get the number of respondents we did. But the cost was pretty hard to beat. That’s because Amazon Mechanical Turk is designed to pay people approximately minimum-wage rates, but for exceedingly short spans of their time. So, if I wanted to pay $12 per hour, but the survey only took the average respondent about 35 seconds to complete, then the total payout for 74 people “working” for less than a minute is incredibly thrifty. In this case, the study cost $8.14.

Research Biz may not be able to promise you a fuel-source satisfaction survey for less than $810. But by creatively thinking about many different ways we might conduct research cost-effectively for you, we do promise to present money-saving ways for your business, association, or organization to take advantage of expertise that works, without breaking the bank.

Thank you for the review

This blog post was inspired by a thoughtful endorsement of my company by Trent Van Doren, a principal officer of Van Doren Oil. I hope to receive many more similar reviews from new clients in the coming months and years.

Please share

As a new research business start-up, we are especially thankful at Research Biz to anyone who will take a moment to comment here or to share this post on your own social media networks. If you have your own examples of “incredibly cheap surveys” (or their pitfalls), feel free to share them with us!

That’s Awesome 👌 I will definitely share with my social media

Here’s an update — Google deleted the 5-star review by Mr. Van Doren, with no explanation given. Perhaps writing here about the review led to a review of the review? Whatever the rationale, the fact of the matter does remain, my business competes with the “Google Surveys” service, so we now have a gigantic mega-company making the competitive playing field a little less level, by diminishing the satisfaction ratings of its competitor. Thanks, Google!